Most entrepreneurs have the ambition to build a business that one day can become a household on a global level. Expanding internationally is a sign of business health and success. Many startups have started their operations in Berlin or London for example to then open new offices in Amsterdam, Barcelona or Warsaw to name a few. This is to gain a competitive advantage or to answer growth needs within the business. Sometimes it’s also to have access to international talent. Setting up a foreign subsidiary is an exciting step for any business, from local to global fame, but it also means that the company must develop a strong understanding of local laws, local tax and business culture, and have local talent in place to run the entity or use costly external legal services.

Depending on the expansion plans and timeline, opening a foreign subsidiary may not be the ideal solution for your business global expansion plans.

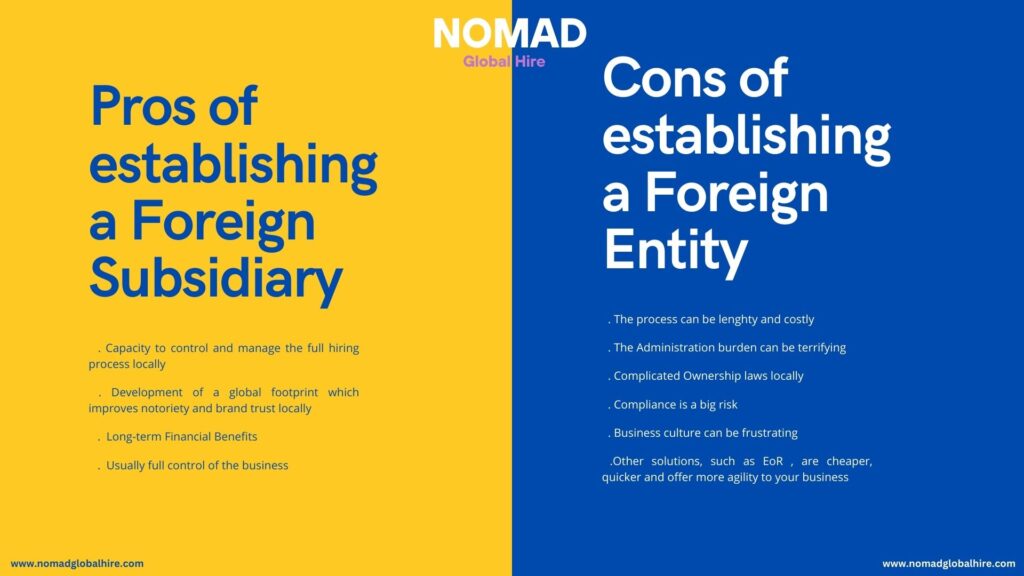

Establish a foreign entity is expensive and takes (too much) time

The expenses associated with setting up an entity in a country can reach several tens of thousands of Euros in just a few months. You will need support from local legal firms for registration, licensing and financial setup of the business, as well as setting up a local team with strong tax and employment laws knowledge to support your newly created foreign entity. To add to the setup and labour costs which will come right from the start when setting up an entity, you may be required to deposit large amounts in required capital deposits.

This can take months to materialise slowing down your global expansion plans. Using an Employer of Record or EoR will ease that process and allow you to start building local presence in days rather than months at a fraction of the cost. This will give you time to start operating early while going through the lengthy entity set-up process if you still deem that option as necessary for your future development.

It requires an understanding of the local business culture and payroll rules

Doing business in the USA is not the same as doing business in Europe. In the same line, doing business in Greece is not the same as doing business in the United Kingdom. It is very important to manage expectations when implementing an entity overseas as the local business approach can differ drastically and you will need to adapt to the local business culture which can be sometimes difficult. This can include the burden of administration, the length of the process, the digitalisation or not of the local economy, the language, the time zone, the currency fluctuations…

Payroll rules are different from a country to another of course, but it’s more about having the ability to understand all aspects of it. Let’s take an example with 13th and 14th salaries paid in some countries in Europe or Latin America, Sometimes it is calculated as 1/12 of the annual gross salary, while sometimes we would divide the Annual gross salary by 14 and pay month 1/14 then accrue 16.66% each month to pay for the other 2 salaries. In Greece for example those are paid across Christmas, Easter, and summer vacation. It can be very complicated to fully understand all the different approaches to payroll and companies setting up a foreign entity will need either the support of legal and payroll agencies to run their own payroll or hire experienced payroll people but that would only be profitable if you had 20+ employees at least. Local tax, payroll and business knowledge is essential for a successful set up in a foreign country.

Some countries have complicated foreign ownership laws

In many countries around the world, full ownership of a foreign subsidiary is not allowed and local governmental laws, such as in the United Arab Emirates, will force you to have a local share owner, sometimes for more than 51% of the business stocks, meaning you will not keep the full control over the business. This can hinder your capacity to act quickly and take the right decisions for the future of your foreign entity.